Home loans make your dream home a reality. Over the last few years, more and more millennials are able to realize their dream of their own house with the help of a home loan. If you have been able to save the down payment part, then approaching a bank and getting a loan is the easiest way of fulfilling your cherished dream of living in your own home. With more people applying for home loans every year, the home loan providers i.e. the banks and HFC’s have come up with different tenure options. So, you can avail of 10, 15, 20, 25 or 30-year home loan depending upon your requirement. While, this option seems great at the outset as you can buy a home with minimum down payment or low EMI. But, everything comes with strings attached. So, if you are on the home loan path, then let’s help you deduce the ideal home loan tenure.

Here is what you need to consider before you decide the home loan tenure

1. The Amount of Home Loan: Once you decide the property you wish to buy and consider the savings, which you can give as down payment for your home, you can check with different banks for the home loan eligibility. Most banks offer up to 30-year home loan and some can even customize the plan for you. But, if you want to increase the home loan tenure, then private sector banks can come to your aid as against public sector ones, which follow stringent policies. So, checking the home loan amount, should be the first step in this direction with different banks.

2. The Interest Rate on Home Loans: After the home loan amount, which different banks are offering, you should consider the home loan interest rate. Ideally, you should opt for a bank, which offers you the lowest rate of interest and gives the freedom of depositing part payment without penalty. This will help you pay off the bank loan sooner. But, if all the other propositions are constant, then go for a home loan with low interest rate, which may actually mean the shortest tenure.

3. The EMI against Home Loan: This will be one of the main, deciding factors as EMI is what you will be paying to the bank every month against the home loan. Studies indicate your home loan EMI should not be more than 50% of your take home. So, if you take home per month is ₹ 2 Lakh, then your EMI should not be more than ₹ 1 Lakh. Usually, a borrower’s tendency is to opt for a low EMI, so that you don’t end up compromising on your lifestyle. Moreover, one also thinks about the home loan tax benefit. But, this may not be the right approach as by paying more EMI you end up saving a lot on the interest rate part.

4. The Age of Home Loan Seeker: When you are certain about the EMI amount you can pay every month, then you should check the age criteria with the bank. A person can get home loan up to 60 years of age. So, you should make the other calculations on the basis of this one factor when buying a home. For instance, if a person is 40 years old, then that person is eligible for 20 years of home loan and not 30.

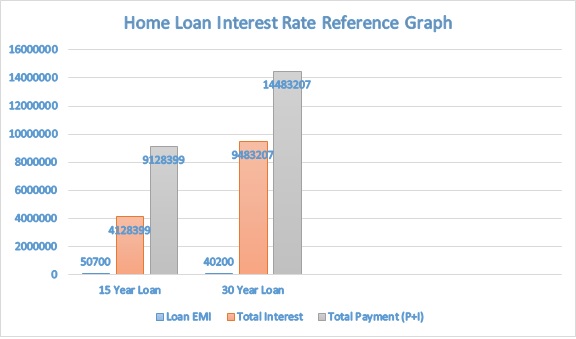

Take into account the above factors when deciding on the home loan tenure. It will be ideal to take a 15-year loan as against 30 as you end up saving big on the interest rate. Nevertheless, if your existing circumstances don’t permit for a shorter duration home loan, then opt for a long term one, but try to explore the part payment option with the bank. In addition, you should also check if you can pay additional money on a monthly basis over a period of time. So, once your home income increases, you should start paying more EMI instead of using that money, elsewhere. The below graph will help you give a better picture.

So, if you take the above graph into consideration, it is made on the basis of ₹ 50 Lakh home loan at an interest rate of 9% for 15 and 30 years’ tenure. So, by paying an EMI of approximately ₹ 10000 extra, you can bring down the interest paid almost by half. It is for this reason that we suggest a shorter home loan tenure. But, buying with a longer duration is also fine because you do get home loan tax benefit and the joy of living in your own home. However, try to divert the additional income and funds in the home loan account and finish it at the earliest. Studies indicate an average Indian closes the home loan account in 8 years-time frame.

If you are looking for apartments in South Bangalore with home loan option, then Valmark Developers can make a fine choice. With all our projects, you can get home loans from leading private and public sector banks. Moreover, our adroit team will be there to assist you not only in home buying, but also in home financing. You can view our projects here and connect with our team for any flat or finance related queries. We believe in offering a holistic and happy home buying experience, holding your hand at every step, helping you with every nitty-gritty. Come visit Valmark for the best home buying experience.