Making an investment in real estate is always considered lucrative. Ray Brown aptly puts it, “the best time to buy a home is always five years ago”. Real estate is looked upon as a safe and secure investment. Something, which is bound to reap benefits in the long term. It is for this reason, that everyone sooner or later puts some investment eggs in this basket. But, investing in real estate is an enormous task. There are many challenges, many apprehensions, which a buyer has to face. So, we list down some common mistakes, which prospective buyers should avoid, before investing in a piece of property. Read on, note and have absolute clarity when you step into a real estate investment.

-

Not Doing the Research: Once you plan to buy a property, the first step should be doing an intensive research. You should research on the

-

Locality

-

Proximity to hospitals, schools, airport and city centre

-

Developers in the area and their reputation

-

Property rates in the locality and neighbouring ones

-

Analysing the market value with other investment properties and compare with the deal you are getting

-

Not Discussing & Consulting: After you have done the preliminary research, you should consult and discuss with friends and family. If someone in your circle has recently purchased a property, then have a proper discussion and try to gather maximum information from their experience. In addition, keep yourself informed about recent policies and changes in real estate like RERA act and GST. If you still need more clarity on your decision, then seek professional guidance from a property consultant and take an informed decision.

-

Lacking Investment Planning: It is also important to plan your investment and figure out what you expect from your best real estate investment. Without investment planning, you may end up paying a lot more, incurring losses. So, have a stipulated budget and stick to it. Most importantly, don’t set your sight on one property. Keep checking more options and evaluating. Along with doing this planning, have a clear expectation from the property you intend to buy. Is it for investment purpose or personal use? Accordingly, list the requirements and try to get the best deal in terms of amenities and price.

-

Forgetting Tax Benefits: There are various government policies providing tax relief to home buyers. It is essential to learn about them, seek these tax benefits and save your money. If you have more than one property and tracking tax benefits is not feasible, then seek consultation regarding your investment property, but ensure you get the monetary gains.

-

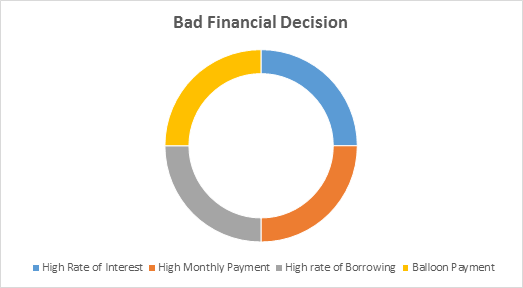

Bad Financial Decisions: This one can cost you big loss and is the trickiest area in real estate investment properties. To ensure you take the right financial decisions, you should first check your credit score with the bank. If you have a good credit score, then apply in different banks and get the loan at the lowest rate of interest. Otherwise, you will land up in the below vicious circle and suffer unalterable loss.

Follow these guidelines to take an informed investment decision. Of course, there is no fool proof way of making any investment, but some due diligence and forward planning can go a long way in taking a favourable decision. If you are planning to buy an apartment in south Bangalore, then you can view the options by Valmark developers. Been an industry player for decades, our properties are located in the most sought after locations in Bangalore. We don’t make just an apartment, but a place you will love to call your home. Designed with care, with detailing, we focus on every bit inside out.View our projects Off Bannerghatta Road, Valmark Apas and CityVille offering luxury and refined living at its best. Come, visit our apartments and see what we have in store for you. We don’t just sell a property, but an experience, which you will cherish, forever.

Disclaimer: All content provided in this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this article. The owner will not be liable for any errors or omissions in this information nor for the availability of this information.